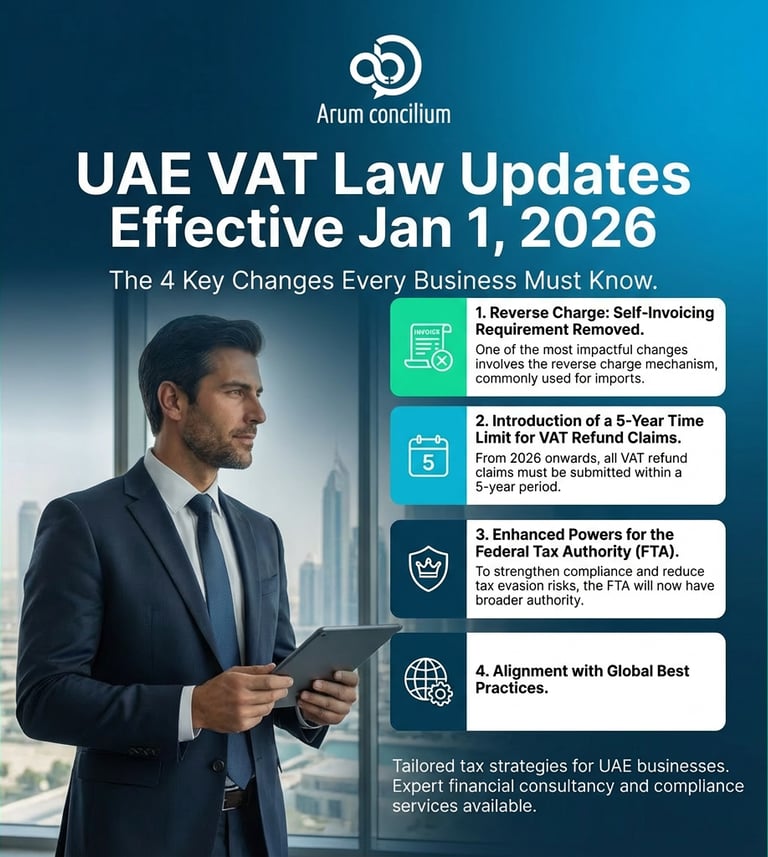

Corporate Tax Planning & Consultancy

In the dynamic business landscape of the UAE, effective corporate tax planning and consultancy services are vital for companies seeking to optimize their financial performance and ensure compliance with local regulations. These services provide tailored strategies that help businesses navigate the complexities of tax laws, enabling them to minimize liabilities while maximizing growth potential. Expert consultants work closely with firms to analyze their financial structures, implement efficient tax strategies, and identify available incentives, ensuring that they remain competitive in the market. By leveraging their in-depth knowledge of the UAE's tax framework, businesses can make informed decisions that promote sustainability and foster long-term success. Whether a start-up or an established enterprise, the right consultancy can transform tax planning into a strategic advantage, allowing companies to focus on their core operations while achieving financial efficiency..